A Booming Hotspot for Fintech Startups

The maturing digital economy and region-wide innovation initiatives make MENA an attractive place to scale or launch FinTech businesses. Consequently, MENA is set to reach US$2.5 billion by 2022, while the number of FinTech companies is expected to reach 1845, quadrupling the number from the year 2015 to 2022.FinTech space in the UAE has grown over the past couple of years. Today, the UAE is ranked as the number one FinTech ecosystem in the MENA. According to an IBS Intelligence report, it is home to almost 50% of the region’s FinTech companies, including FinTech startups with the highest total funding like Channel VAS, Beehive, Telr, NOW Money, Yallacompare, Sarwa, BitOasis, and Tarabut Gateway. Most of the above-stated FinTech companies are strategically located in the leading financial free zones in the UAE -Abu Dhabi Global Market and Dubai International Financial Centre.

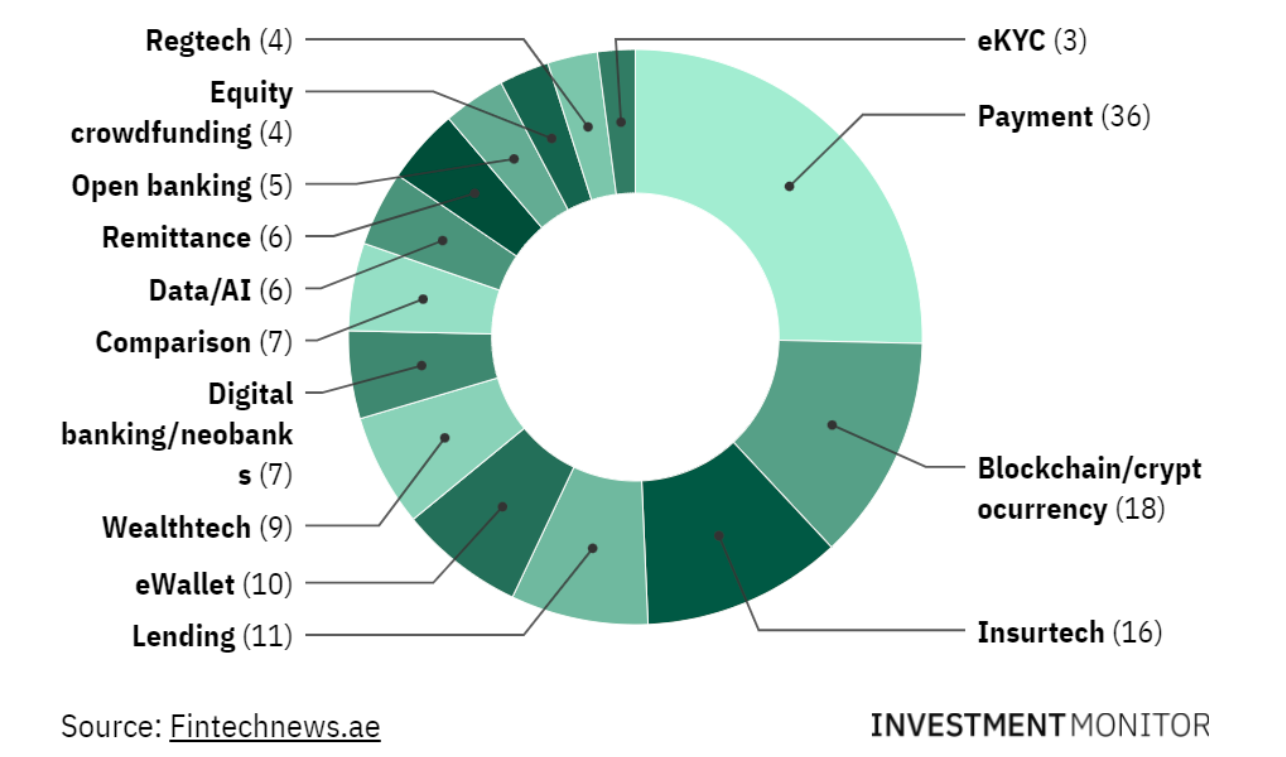

Exhibit 1 shows the breakdown of FinTech companies by subsector in the UAE last 2021. As illustrated, payment companies (36%) dominate the industry, representing around a quarter of all FinTech companies. Moreover, blockchain (18%) and insurtech (16%) are two of the biggest FinTech subsectors in the UAE, followed by lending (11%), eWallet (10%), and wealthtech (9%). Meanwhile, emerging sectors like open banking (5%) and data/AI (6%) remain relatively few but are expected to grow in importance over the coming years.

This year, Finextra forecasts that 465 fintech companies in the UAE will generate about $2 billion in investment capital funding, compared to $80 million in 2017.

According to Ramzi Khleif, general manager of StashAway MENA, the UAE’s booming FinTech ecosystem is due to its agility, low entry barriers, and its leaders’ forward-looking vision. He also stated that “The rise of FinTechs in the UAE has made it possible for financial institutions such as banks but also startups to offer digital services that are tailored to the needs of each customer.”

Dubai has become an attractive hotspot across the Middle East for various FinTech companies. The emirate has established Dubai International Financial Centre (DIFC) to house hundreds of financial institutions, including wealth funds and private investors. It is also one of the independent free zones in Dubai that offers companies 100% ownership without the need for a local partner.

Today, DIFC is home to over 350 firms that specialize in FinTech applications and solutions. Through the US$100M DIFC FinTech Hive Accelerator fund, DIFC provides financial and logistic support to FinTech, InsurTech, RegTech, and Islamic FinTech startups. Furthermore, Dubai Financial Services Authority (DFSA) also offers business owners an innovative testing license to assist startups to test their concept within DIFC from six to twelve months for Investment entities in UAE.

Final Thought

Without a doubt, FinTech investing in Dubai is a flourishing industry. The government recognizes its potential and introduces various initiatives to encourage more FinTech investors and companies to do business in the country. Furthermore, as this technological innovation continues, many financial institutions are seizing the opportunity to use the technology to modernize their offerings and be competitive in the marketplace.

This is thanks to a lack of short-term holders (STHs) on the market, Root notes. Even the most recent all-time highs of $69,000 last November came with relatively few speculatory bets — something which contrasts strongly with the all-time high during the last halving cycle in December 2017.